Return Policy

Dicks Sporting Goods Coupon Code Take 20 Off 100+

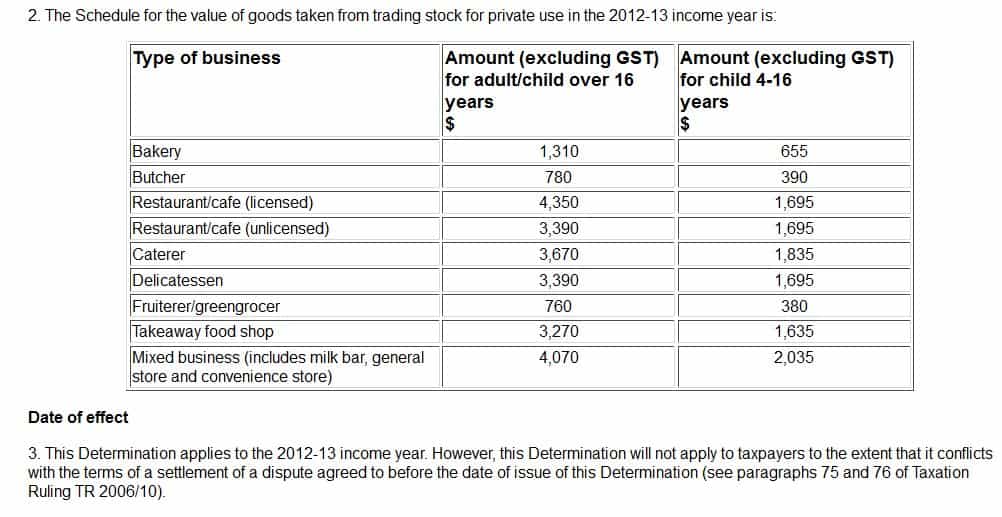

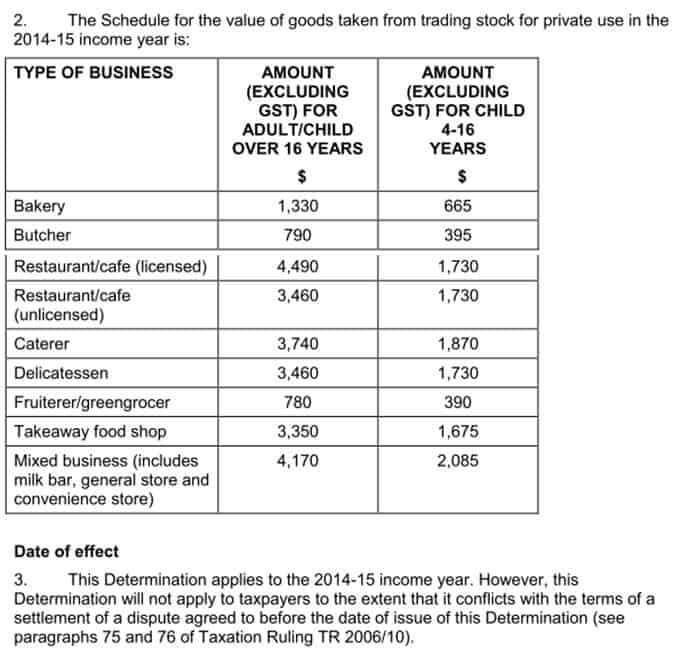

A business can keep records of the actual value of goods taken from its trading stock for own private use and report that amount. Alternatively, it can use the amounts the ATO will accept as.

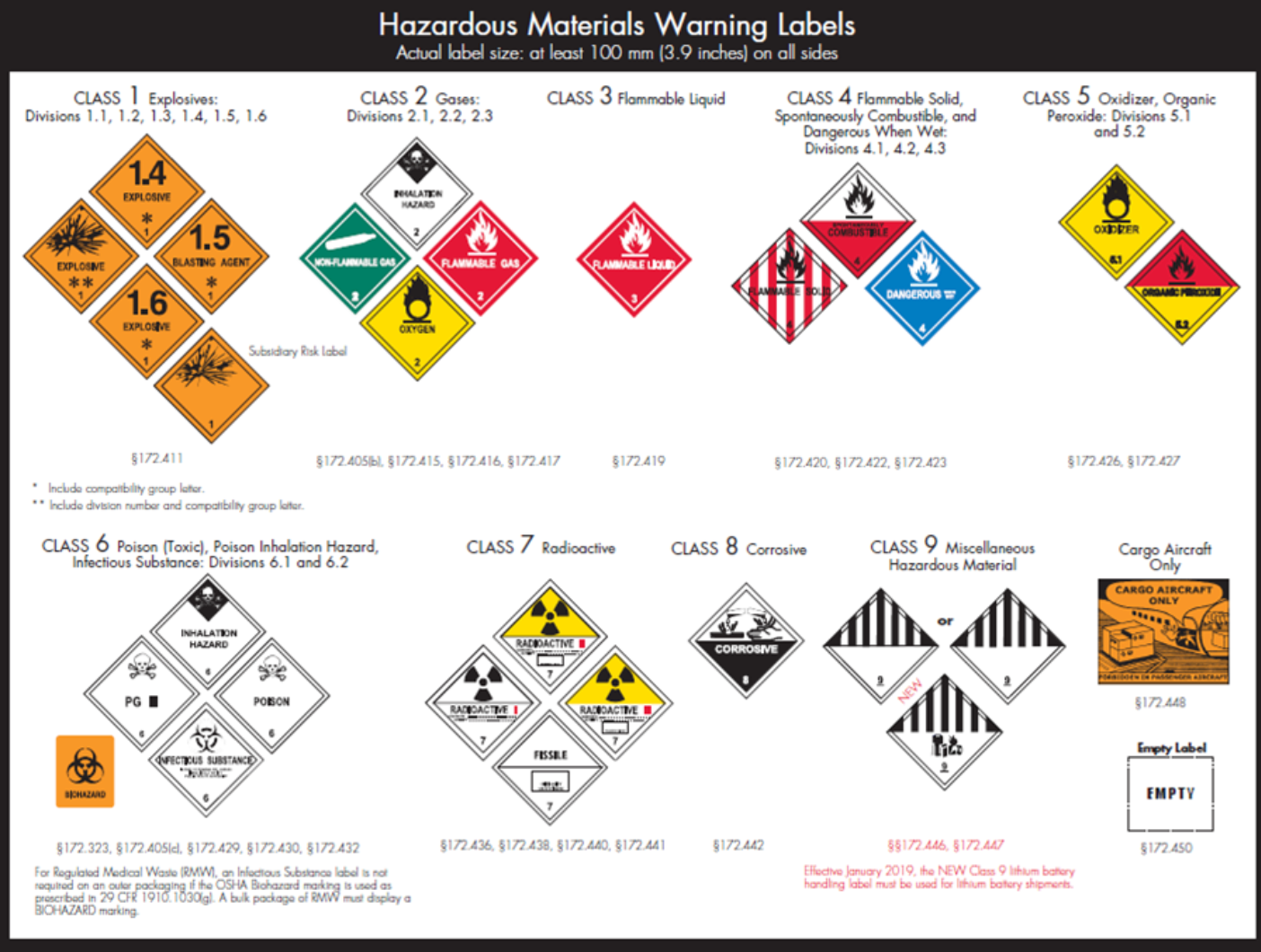

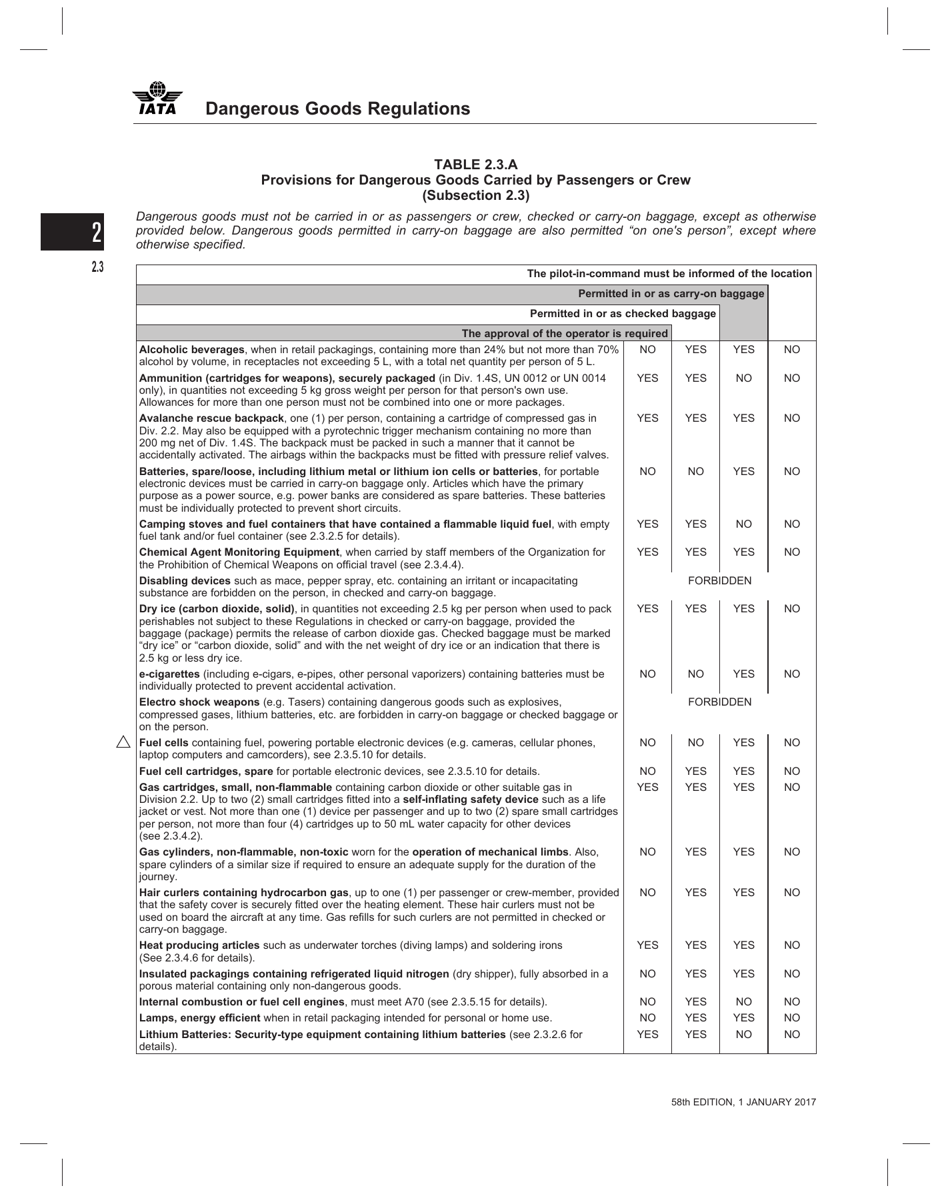

What are the Shipping Rules for Dangerous Goods? DCL Logistics

On any goods or items from stock that you remove for your own use you will have to account to the business for the full selling price and assuming that you are VAT registered, the VAT applicable to the sale. Date published 5 Dec 2012 This article is intended to inform rather than advise and is based on legislation and practice at the time.

Goods Taken From Stock For Own Use 2023

Using goods privately. Businesses often supply their own goods and services for private use. You may have to account for VAT on them if you're VAT-registered and your business: buys and sells.

Goods Taken Date Stamp Stamp Lab

value of goods taken from trading stock (the Schedule) at paragraph 2 of this Determination. Schedule for the value of goods taken from trading stock 2. The Schedule for the value of goods taken from trading stock for private use in the 2022-23 income year is: Table 1: Values of goods . TYPE OF BUSINESS. AMOUNT (EXCLUDING GST) FOR ADULT/CHILD

What is the legality of the ‘goods once sold’ phrase? Monitor

The ATO has updated the amounts it will accept as estimates of the value of goods taken from trading stock for private use by taxpayers for certain named industries in the 2021-22 year. Taxation.

All Products Sold As Is No Refunds Or Exchanges Sign NHE33932

That's 11 points higher than a similar poll from just over a year ago in March 2023. The belief that home ownership is the domain of the rich is most widely held among younger Canadians.

Goods distributed as free sampleGoods taken by Prop. for personal usefinal accounts class 11

In a recent development, the Australian Taxation Office (ATO) has revised the acceptable estimates for the value of goods taken from trading stock for private use in the fiscal year 2023-24. This update brings forth important considerations for taxpayers, especially those in specific industries. Taxation Determination TD 2023/7 sets out the.

7 Stores That Pay You to Bring a Reusable Bag

The ATO regularly issues guidance for business owners on the value it expects will be allocated to goods taken from trading stock for private use. The table below shows these values for the 2023-24 income year.

What Are Responsibilities of the Seller for Inadequate Delivery of Goods? ANT Lawyers in 2021

Since December 2023, there is a new clause which applies to EU exporters and contractually prohibits re-exportation to Russia and re-exportation for use in Russia of a limited number of goods, when selling, supplying, transferring or exporting to a third country, with the exception of partner countries. The clause covers prohibited: dual-use goods

Goods Taken From Stock For Own Use 2023

In Taxation Determination TD 2022/15, the ATO has updated the amounts that it will accept as estimates of the value of goods taken from trading stock for private use by taxpayers for certain industries in the 2022/23 year. The updated amounts are set out in the following table: TYPE OF BUSINESS. AMOUNT (EXCLUDING GST) FOR ADULT/CHILD OVER 16 YEARS.

Goods Taken From Stock For Own Use 2023

The ATO regularly issues guidance for business owners on the value it expects will be allocated to goods taken from trading stock for private use. The table below shows these values for the 2023-24 income year. The basis for determining values is the latest Household Expenditure Survey results issued by the Australian Bureau of Statistics,

Luxury Goods Market Outlook 2020

02 Dec 2023 Taken goods for private use? Here's the latest values. The ATO knows that many business owners naturally help themselves to their trading stock and use it for their own purposes. This common practice can occur in businesses such as butchers, bakers, corner stores, cafes and more.. The table below shows these values for the 2023.

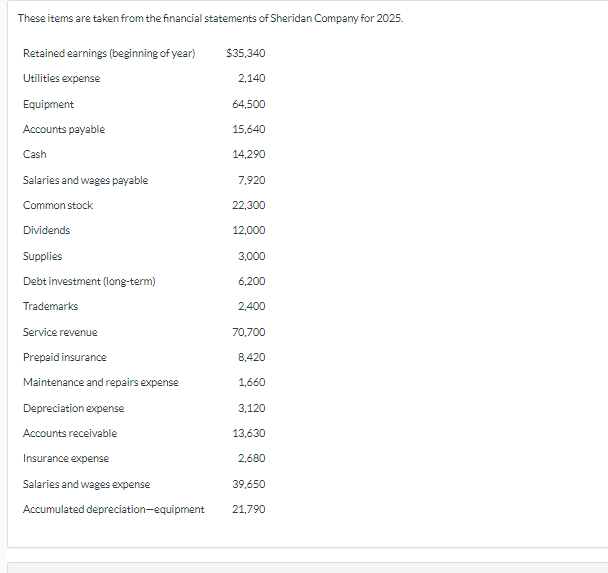

[Solved] These items are taken from the financial s

For the 2023-2024 payment period. RC4210(E) Rev. 23. is a non-taxable amount paid four times a year to individuals and families with low and modest incomes to help offset the goods and services tax/ harmonized sales tax (GST/HST). They will both get their own GST/HST credit for the rest of the payment period following the separation date.

Secondhand Shopping Is Trending—But Is It Still Sustainable? Brightly

The Commissioner recently issued his annual determination TD 2021/1 ( the Determination) which provides an update of amounts that the Commissioner will accept as estimates of the value of goods taken from trading stock for private use by taxpayers in named industries for the 2020-21 income year. Indexed each year, the annual assessable amount.

Table 2.3.a Provisions for Dangerous Goods Carried by Passengers or Crew (Subsection 2.3

value of goods taken from trading stock (the Schedule) at paragraph 2 of this Determination. Schedule for the value of goods taken from trading stock 2. The Schedule for the value of goods taken from trading stock for private use in the 2020-21 income year is: TYPE OF BUSINESS AMOUNT (EXCLUDING GST) FOR ADULT/CHILD OVER 16 YEARS AMOUNT (EXCLUDING

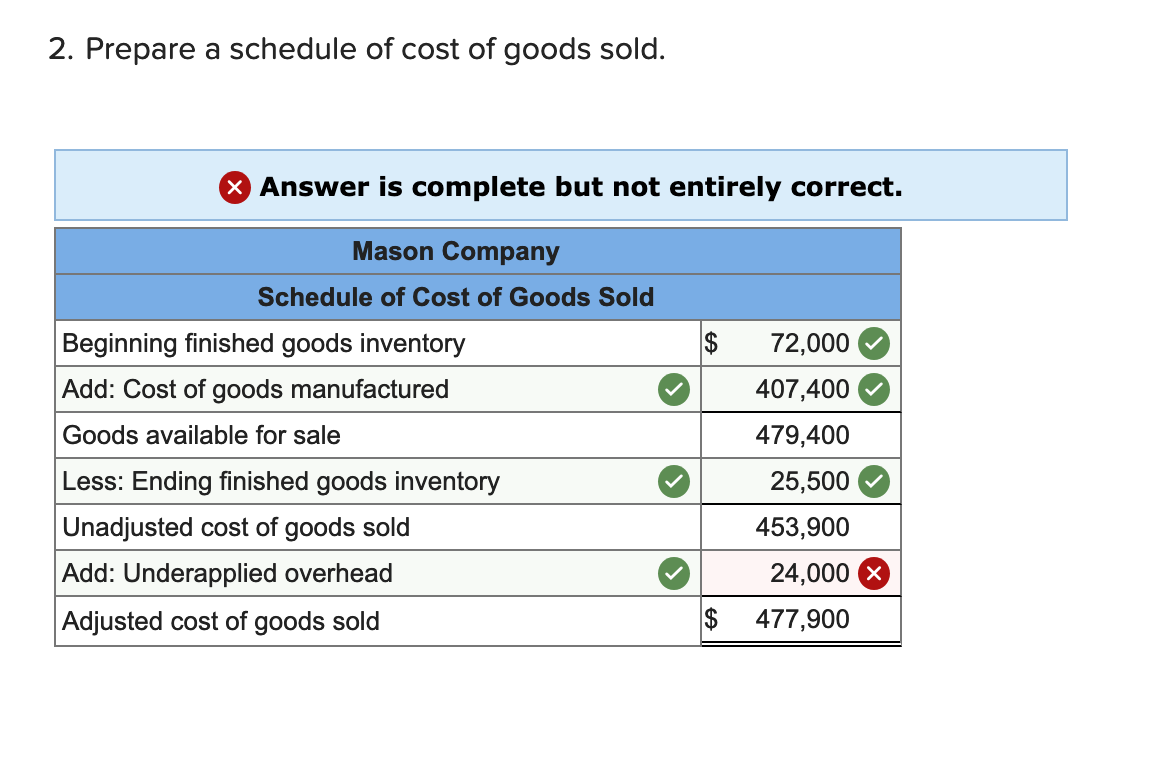

Solved The following data from the just completed year are

This common practice can occur in businesses such as butchers, bakers, corner stores, cafes and more. It regularly issues guidance for business owners on the value it expects will be allocated to goods taken from trading stock for private use. The table below shows these values for the 2019-20 income year. Type of business.