How do I find out what my superannuation fund invests in? The Australia Today

REST Super guide Performance, fees, USI, ABN, address, contact details

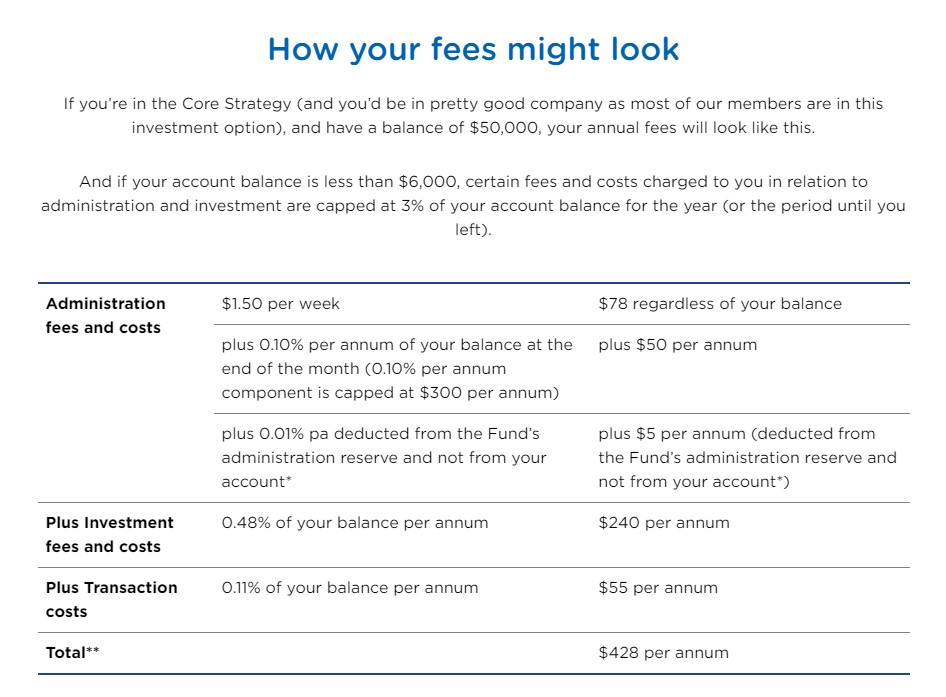

Compare super fund fees for large balances. Most super funds outline their annual fees in their PDS based on a set balance of $50,000. Our comparison table above also shows the annual fees based.

Overview Australian Expat Advisor

The YourSuper comparison tool is designed to help people compare the investment performance of super funds, as well as the fees they charge. and ADF Super just below mid-range for investment performance over the last six years (6.06%), compared to the leading funds at 8.1%. and ADF Super annual fees (for a $50k balance) are $659 compared to the.

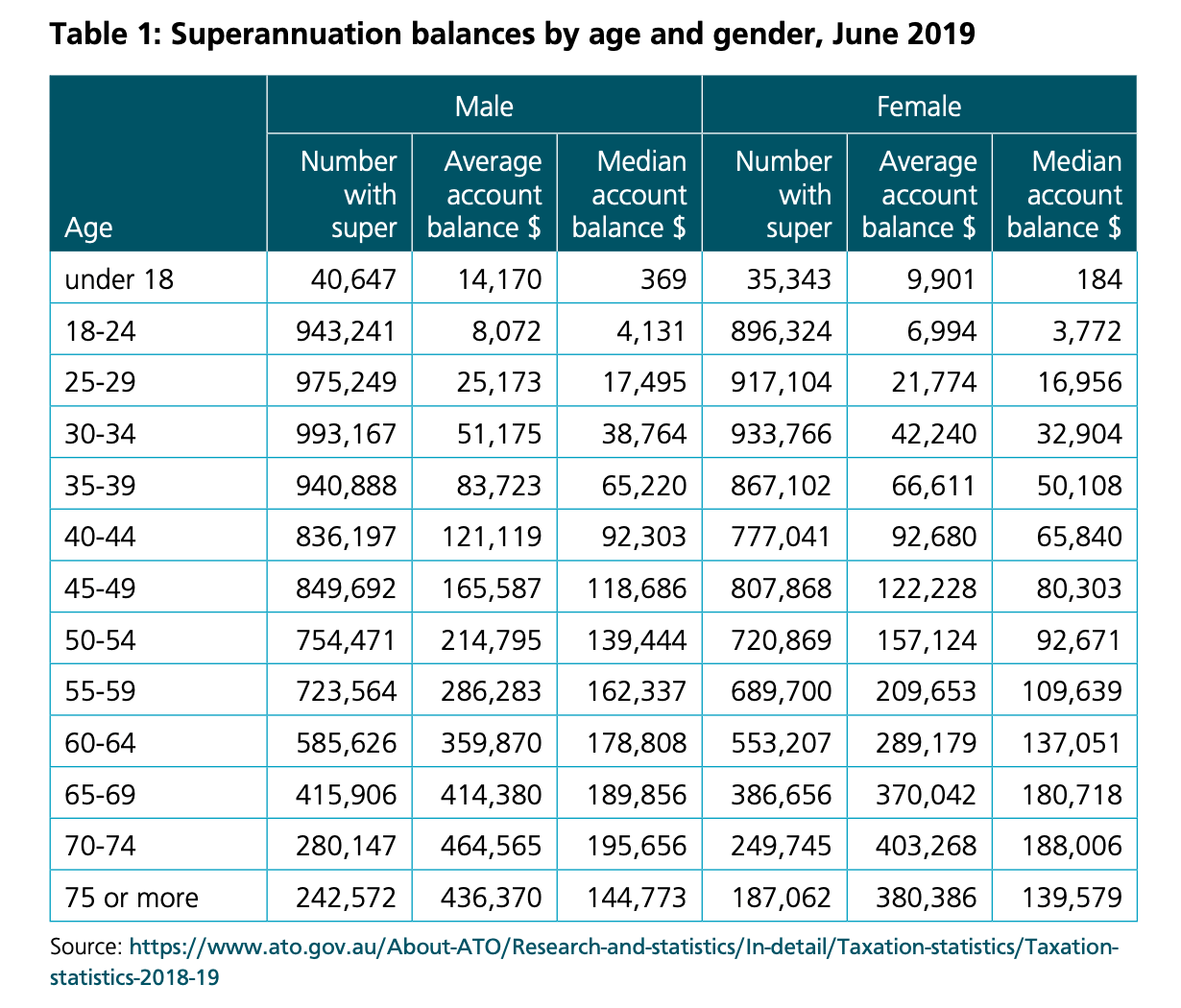

Superannuation in Australia, 2022 Survey Men Twice as Likely as Women to Have a Higher Balance

Super you can trust. Everything we do is to benefit our members, not shareholders. Being profit-for-members means you can be sure we're working in members' best interests, not someone else's. More than $240 billion in retirement savings. 140 years' combined experience helping members 5. 2.2 million members and counting.

Rest Super agrees to align portfolio to climate goals

REST yielded a return of 4.5%, while Hostplus returned 4.21%. This stood significantly better than Australian Super's return of 3.02% over the same time frame. Over 5-years, Australian Super's performance picked up, achieving a return of 3.49%. In contrast, REST delivered 3.50%, with Hostplus decreasing to 2.94%.

Australian Retirement Trust vs AustralianSuper Review My Super

ART vs Rest Super: How do fees compare? When comparing ART and Rest Super, ART has annual percentage based fees, with a 0.89% investment based fee, compared to Rest Super's percentage based fees of 0.81% ART has a flat fee of 62.4, while Rest Super has a flat fee of 78.

REST Super review How do they stack up? Captain FI

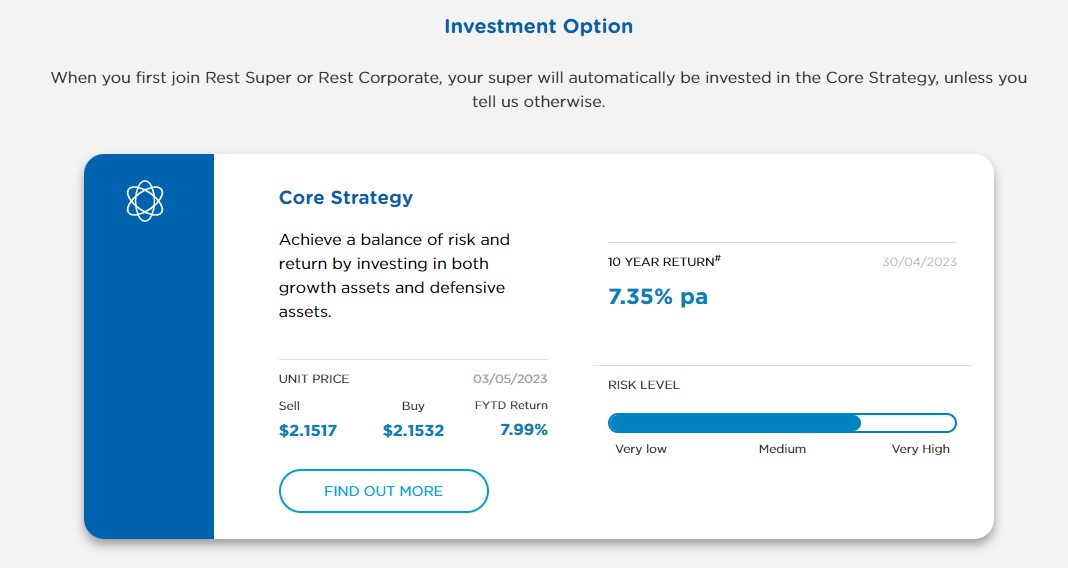

REST Super High Growth: 88.3%: High growth REST Super Diversified: 72.3%: Growth REST Super Core Strategy: 70.9%: Growth REST Super Balanced: 52.3%: Balanced REST Super. Barbara is a financial journalist and author with over 30 years' experience in Australia and the UK. She is a contributor to The Sydney Morning Herald and The Age Money.

Rest First Nations Foundation

Compare us with other Australian superannuation funds. Use Chant West's free AppleCheck comparison tool to compare investment options, performance, fees, net return (net benefit), insurance and member services. You can use this tool to compare funds including Australian Super, Telstra Super, Rest, Aware, Australian Retirement Trust and Hostplus.

AustralianSuper VS Rest Super Review My Super

Rank Fund Investment Option Return Return Period Website Date Category Return Period Fund ID; 1: REI Super - Australian Shares: 17.13%: FYTD: More Info: 31/03/2024

Pin on Important Marketing Information

AustralianSuper Rest Super; Type of fund: Industry super fund and Australia's largest super fund: Industry super fund aligned to the retail sector: Number of members

Rest Superannuation (page 2)

Last 10 year performance (p.a.) +6.73%. Fees on $50k balance (p.a.) $433. Compare. Showing 16 of 16 results. Unless indicated otherwise, the information in the table is based on data provided by.

REST Super review How do they stack up? Captain FI

At AustralianSuper we're focused on delivering strong long-term investment performance for members. To see our super or account-based pension performance, click through the tabs below. Join today. Super & TTR Income Account based pension Choice Income. graph.

How Much Superannuation Should I Have? SuperGuy

Rest Super vs AustralianSuper: How do fees compare? When comparing AustralianSuper and Rest Super, AustralianSuper has annual percentage based fees, with a 0.66% investment based fee, compared to Rest Super's percentage based fees of 0.81%. AustralianSuper has a flat fee of 52, while Rest Super has a flat fee of 78.

Departing Australia Superannuation Payment (DASP) Explained Rest Super

Currently on their Balanced - Indexed option. I haven't looked at changing funds in the past but am starting to get on top of my finances (finally) and I was wondering if I'm on the best option I can get at the moment and looking forward to the future. Current super balance is $88k. I've seen rumblings of options at Australian Super and.

You're an average Australian what should your super balance be now? Stockhead

Rest superannuation is a leading super fund in Australia. Compare and review its features, fees and performance with Canstar, the expert in financial ratings.

A positive year for your super returns AustralianSuper

An advice fee may be payable for complex advice and you should read the Rest Advice Financial Services Guide, which you can obtain by calling us on 1300 300 778, before accessing these services. Super Investment Management Pty Limited ABN 86 079 706 657, AFSL 240004, a wholly owned company of Rest, manages some of the Fund's investments.

ASIAL

What this tool does. The YourSuper comparison tool: displays a table of MySuper products ranked by fees and net returns (updated quarterly) allows you to select and compare in more detail up to 4 MySuper products at a time. links you to a super fund's website when you select a MySuper product from the table.